My premise is that the 401k WAS NEVER ORIGINALLY designed to be a true retirement instrument , (one that accounts for inflation and is not subject to the whims of the market, aka potential declines, and offers a steady stream of income into retirement). I’m going to outline there are substantial risks in 401k as your primary retirement account, if you blindly just let your money sit there and not manage your 401k assets, you may be in for a rude awakening. Finally I’ll suggest some strategies to help mitigate these risks and help keep most of your hard earned money. To see how you’re long term retirement account may play out, run the numbers in my retirement calculator

Originally 401k – began as a TAX SHELTER (Dodge?) for executives

Did you ever wonder why the most common retirement savings plan in the US has such an odd sounding name.. 401k, huh? what does that mean? 401k plan is the tax-qualified, defined-contribution pension account defined in subsection 401(k) of the Internal Revenue Code [Source:401k] The IRS rules were originally created in 1978 , but it took a f ew years before benefits consultant Ted Benna , came up with a ingenious use for it.

In 1980, Benna noticed that the rules established in the Revenue Act of 1978 made it possible for employers to establish simple, tax-advantaged savings accounts for their employees. During this time the late 70’s and early 80’s most employees of large companies had defined benefit pension plans, which generally formed the backbone of their retirement. But certain high salary individuals, typically middle and upper level executives at companies, were looking at a way to TAX SHELTER their large paychecks , so Ted Benna and others at financial services firms, figured out that using this 401k rule, it allowed these high salary folks to defer or move some of their money into tax-advantaged savings (for complete historical details go here: http://401kbenna.com/401k-history.html) .Eventually over time, more and more companies began to see the benefits of this approach for all their employees and the 401k industry was born.

Financial services firms quickly jumped in , seeing a huge market because of the management fees (more on those pesky fees later) they could charge to companies to manage these accounts, and companies over time eventually saw it as a cost savings and as way to put the onus for retirement savings on the employee as they slowly did away with defined benefit pensions, which brings us to the system we have today. It just morphed into the de facto retirement account one over time, and most folks that have plans don’t understand them or take very little time to manage them and that is a huge danger as primary retirement vehicle, as I’ll highlight below.

Why is a 401k Risky? Market Fluctuations…

At its most fundamental level 401k is not inherently a risky instrument. If all your 401k contributions (savings) go into cash equivalent account and your company matches a percentage of your contributions, then the 401k original purpose of tax deferred savings account works without much risk, however there’s little to no growth and you actually suffer from inflation risk…. (or to a lesser extent currency devaluation risk)..

The risk comes from the fact that most 401k retirement plan savings are placed into stock and bond market INVESTMENTS , which almost all plans offer and some plans have this as their default contribution allocation setup. This means that your retirement savings could suffer a substantial loss, if market conditions change rapidly, and this is exactly what happen in 2007-2008 financial meltdown.

While most financial planners recommend you move your allocation strategy over time (move away from from stocks into bonds), as you get closer to retirement age , there’s no guarantee the market will recover like it did after 2007-08 , you may be the unfortunate victim of a bad market environment and timing that you may never recover and get all your money back, over the course of your lifetime.

The reality is unless your in an ALL CASH position in your 401k, you may not be able to move your savings fast enough to avoid hemorrhaging large losses during another financial crisis, and you many not ever recover all your loses in a reasonable time window. Put it succinctly as CBS’s 60 Minutes segment asked of 401(k)s,

“What kind of retirement plan allows millions of people to lose 30-50 percent of their life savings just as they near retirement?”

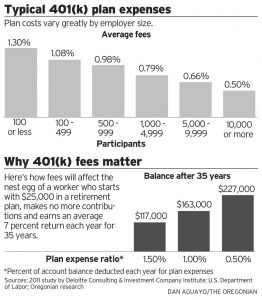

Hidden Fees eating as much as 40% of your 401k

Another risk in your 401k is the management fees, while it may seem small 1% here 2% there, over time these fees will eat into your retirement savings..

Examples often cited are:

If you you save $10,000 a year for 30 years in your 401(k). If you average 7% returns annually and pay 0.5% in annual expenses, you’ll finish with about $920,000 saved. However with 1.0% in annual fees, that total drops to a little less than $840,000 — and if you suffer 2.0% in annual fees, your finishing total is just under $700,000. (source: USA today )

This is because fees eat away at the benefit of compounding money on your returns., you can easily loose tens or hundreds of thousands of your hard earned dollars into fees over a 30 year period. Many times plans are purposely crafted by the financial services companies that make deals with your employer to limit which investments options you have to choose from, generally they are all high fee options that are geared to making the financials services firm a steady stream of income, with little concern for your long term interests.

Returns nor guaranteed – no cash flow opportunities

Be skeptical of the 7% hype.. Most retirement advisers like to comment that the equity (stock) markets , on average return 7% over a typical 30-40 year cycle , long position. But there’s no guarantee this will continue into the future, we live in a very integrated and global economy , geopolitical risks , economic risks can quickly evolve and as we saw in 2007-08 within a period of 8-10 months can wreak havoc on public markets, combine that with the fact that the US Dollar may not always be the global reserve currency and you have a myriad of external risks that can affect your retirement savings. In other words that little disclaimer at the bottom of most investments , heed its warning.

“Past performance is no guarantee of future results.”

Your money is locked away – can’t touch it till retirement. That is you can’t really move it out of “your retirement plan” , say to invest it into a non-market investment opportunity. For example, what if a real estate opportunity makes itself available, or perhaps a business you had your eye on comes up for sale? nope you can’t use your retirement money for that…

You can’t easily get your money out without substantial penalties or taking loans against your own money. Now the government argument can be made this is just a way to protect you form possible losses, but the reality (As noted above) there’s nothing inherit in the 401k that will protect or guarantee your growth (one of my main points) .

The government OWNS your 401k and rules can be changed..

You may be surprised to learn this, but your 401(k) does not even technically belong to you. Read the fine print and you will find “FBO” (For Benefit Of). The tax code makes it technically owned by the government, but provided for your benefit. This is why when you transfer money between accounts you need to carefully make sure you make out the check to FBO, otherwise the government thinks your cashing it out.. There’s a tiny risk (really small) that in a real crisis the government could re-appropriate or borrow money from 401k , again this is highly unlikely to happen in the US barring some true financial calamity, but just something to keep in mind. My concern would be the government messing with withdrawal dates, as of 2017 the earliest you can withdraw your money (penalty free) is 59 ½ years old. What is they push it back say to 65 that gives the government time to take advantage of the tax savings.

It’s not all gloom and doom.. Strategies: what you can do…

So now that you see some of the reasons why a 401k can be risky (and there are a few more: https://www.entrepreneur.com/article/242113 ) what can you do ? what options do you have? Well that depends on your level of paranoia.

If you’re mildly paranoid : simply move some or ALL of your 401K investments into cash equivalents. Of course then you suffer the inflation and currency risks of being in an all cash position. or you can move them into a GOLD ETF .

If you’re extremely paranoid…First for maximum safety (if you feel that the capitalistic markets will implode), cash out, pay the hefty taxes and fees, cash out you 401k ( 10% penalty + 25% or current tax bracket + state tax fees more details on early 401k withdrawal) , and stuff your money (or gold) under a mattress, along with your guns and ammo.

Obviously this last approach is extreme has some serious drawbacks (inflation risk, theft loss of money) , but it is the only one to guarantee your money in case of a true global catastrophe, which even my pessimistic self feels is pretty low …

A more balanced approach is to do the following:

- Be your own fiduciary and Actively manage your 401k!: Re-balance, Re-balance, Re-balance: Check on your investment mix monthly or more frequently , and if you sense a major market correction coming, move your investments into more protected asset classes (bonds , cash equivalent or GLD ETF etc. ), while most experts don’t recommend you time the market, I beg to differ, you should do what you can to protect your investments gains. Just staying the course to be true to market theory, is not my preferred strategy. Stay ACTIVE and manage your money, otherwise it will end up managing your retirement lifestyle.

- Fund your 401k up to the max employer match, then if you want to make any excess savings, take the excess and fund your OWN private ROTH IRA (post -tax dollars that grow tax free), or if your more worried or don’t have an employer match, fund more of your retirement savings into own ROTH account, something like the Vanguard STAR fund, see this excellent retirement guide on clark.com ).

- Nearing retirement age (55+)/Weigh tax implications ; consider taking your money out, especially if market conditions are turning sour. Withdrawal ages and tax implications are varied (due to factors such as are you still working, retired? etc ) so check the rules here.. (Rules and ages on 401k withdrawals) As you get closer to retirement age, consider whether its better to make large or small withdrawals this mostly revolves around tax implications.

-

Diversify! into HARD ASSETS: Diversification is a common mantra in the stock and bond markets, but I say diversify beyond equities and bonds into hard assets. You may be surprised there are many wealthy (multi-millionaire wealthy) individuals who are not involved with any stocks or bonds.. So how do they make their money? hard assets, such as real estate rental income, businesses royalties and other business income, any number of cash producing enterprises. Do consider putting some of your money to work in real estate, Gold, foreign investments, invest in small businesses (Maybe a Car wash?), etc. consider moving a reasonably portion (15-35% ) of your retirement into hard assets.

At the end of the day,this all boils down to one simple rule, Actively manage your own damn retirement account, don’t rely on others unless you can trust them and you know they are working for your benefit (a true fiduciary), if you don’t have the ability to do it yourself.. Then find a trusted adviser (I stress trusted), that will do it for you even for a fee, after all your retirement and peace of mind is too valuable not to.

Good tip on getting out after age 55, serious never considered that..

Good article , finally some sanity to 401k , none of my co-workers care or are aware of how it works, but like the article mentioned too many external risks to simply let it be…